A Year Later: Why I’m Still Bullish on NBA Top Shot (Plus My 2022 Predictions)

A year ago today, I did something that forever changed the course of not only my life, but so many lives around me. An event that honestly made me see the world through an entirely different lens. It wasn’t even something I put much thought into, but I’m forever grateful it happened.

I ate at a Red Robin for the first time, and I simply haven’t been able to stop telling people about it. The burgers. The ambiance. The neighborhood hospitality. I’m getting teary-eyed just thinking about it. Redddd Robin. Yummmmmm.

I also wrote an article later that day that some of you read. It was titled “I Spent $35,000 on a Video You Can Find All Over the Internet: Here’s Why” and it explained why I was getting into NBA Top Shot and NFTs.

I Spent $35,000 on a Video You Can Find All Over the Internet: Here's Why https://t.co/x0dTFTqDyU

— Jonathan Bales (@BalesFootball) January 15, 2021

In all seriousness, I didn’t put a ton of thought into that post. I was writing in my newsletter quite a bit at the time—often about investments or my business philosophies—and just wanted to talk about something cool that I had been doing with my friends.

NBA Top Shot had sort of taken over my life in the prior couple weeks. In an article I posted on Lucky Trader called 5 Things I Learned About Investing, I mentioned I’ve developed a bias toward non-action, meaning if you aren’t sure if a decision is smart, don’t act. There are a variety of reasons I think that’s generally true (in investing, not other areas of life), but one is so that you’re ready to fucking fire when the truly good shit comes along, which is rare.

And I’ve seen only a handful of these opportunities in my life: online poker, daily fantasy sports, sports betting legalization, crypto, betting on Trump to win in 2016, betting on Trump to lose before he lost in 2020, betting on Trump to lose after he had literally already lost in 2020, doing mad push-ups for money, and now NFTs (with Top Shot being the first that clicked for me).

I had purchased NFTs in the past (if things go south for me I might need to get back into breeding digital cats), and I had even written about digital art in late 2019. In a post about how to find the next big thing (that I hid behind a story about pretending to be a professional quarterback’s son to sneak into the team’s locker room because I was scared you guys would judge me about buying digital art and boy was I wrong spot on because jfc you’re all relentless), I mentioned some of my investment theses behind purchasing digital art and super high-end, vintage physical sports cards.

So when I found Top Shot, it just clicked. It combined all my natural curiosities and possessed all the traits I was looking for in investments:

- Trading cards/collectibles

- Art

- NFTs

- An industry poised to move from physical to digital

- Liquid market

- Asymmetric upside

I stayed up all day and night for weeks buying, selling, learning. I’m not really active in chats and I hadn’t even told my friends about it in the beginning, so I don’t think many people knew I was involved. But then one day I decided to just go ham (H.A.M…hard as a motherfucker. It’s a term used by young people like me, now 36 and trying to get more fiber into my diet which is sort of killing the vibe around the ladies but you really can’t overlook your digestive health).

I started buying up all the LaMelo Ball Series 2 rookie Moments to see what would happen. I bought dozens of them and heard through a friend, “Discord is going crazy. They think you’re a fucking moron.”

I said, “Who’s Discord? Is that someone on DraftKings?”

It seems like years ago. At that time, believe it or not, people weren’t spending all kinds of insane money on .jpgs and .mov files. In fact, many of you even said some incredibly hateful things about me after reading the article. I remember the insults so vividly.

“You’re a no-good scoundrel!” said one of my followers.

“If I didn’t know any better, I’d call you a dummy!” exclaimed another.

Ouch!

Once people realized I was involved in Top Shot, I figured I might as well write about it. And now, on the one-year anniversary of that article, I thought it would be a good time to do a little encore. I’ll answer some questions I get about Top Shot and the Ja purchase, recap what I think I got right and wrong last year, and then give some predictions for 2022.

But first…

I’m Giving Away a LeBron James Moment I Bought for $35,000

This is a celebration! Seriously, I’m so grateful for all of the amazing friends I’ve made over the past year. I mean, I use the term “friends” very lightly, in the sense of like I mildly enjoy interacting online, not in the way that I use the term for my real friends—I’d literally never meet you guys in person—but still, you’re my internet friends nonetheless.

So to celebrate our ability to casually chat via Twitter in our spare time and then log off and potentially never interact again, Lucky Trader is giving a $35,000 LeBron James Moment I bought, plus 100 Top Shot packs. You can enter using the form below, or at this link.

The winner will be selected live on Tuesday night at 9:00 p.m. ET on Club Top Shot via the Lucky Trader YouTube Channel.

Also, I didn’t tell anyone I’d be doing this so it’s not going to be as formal as the LeBron giveaway which will use like a real randomizer and stuff, but I’ll also give away this Damian Lillard Metallic Gold Series 1 Moment that’s in my collection if you go buy a Moment at Top Shot, any Moment, and tweet me a screenshot (with the timestamp) at @BalesFootball on Twitter.

I’ll also randomize the winner, meaning I’ll close my eyes and just sort of like rapidly scroll up and down through my Twitter mentions and then stop and whoever I see first wins.

A little easter egg for the real Gs reading all this.

Answering a Few Questions

Before my recap of the past year and predictions for 2022, I wanted to touch on a few of the questions I receive most often, the most common of which is…

Are You Still Bullish on Top Shot?

Uh, yeah, read the title dumbass?

The way I make a lot of decisions in most games is often to reverse-engineer what an optimal strategy looks like by thinking about what needs to happen for a win, or positive outcome, and then working backwards from there. What assumptions need to be met, and if those things happen, what are the various outcomes?

Taking Top Shot as an example, my (crude) thesis is the same as last year. I don’t know how the Top Shot market will move in the short-term, but for the site to reach its long-term upside, we’d need to see:

- NFTs to continue to grow.

- Collectibles/art to be part of that growth.

- Top Shot to win within “digital trading cards.”

Then I’d estimate the probability of each. And to be clear, there’s no extremely accurate way to do this; I basically just guess. With practice, you just get better at pattern recognition and making better guesses.

Let’s say we assign 70%, 90%, and 70% probabilities to each of the items above; the odds all three come to fruition would be 44.1%. So that’s a bad bet, right?

No, it’s an amazing bet, because if all these things happen, Moments will be worth far in excess of what they are today. If you’re getting 10x on roughly a coin flip, that’s incredible.

The point isn’t the exact numbers, but rather if you can reverse-engineer the correct assumptions that will lead to a win and project their likelihood even remotely intelligently, the right types of bets become very obvious even with conservative estimates. If it isn’t screamingly evident the potential reward is worth the risk, forget it.

I’m looking for asymmetrical upside. You don’t need to be a data scientist to uncover those opportunities at a macro level. You need to have some sense of where the world is headed while cultivating the skill of pattern recognition to ask the right questions and make decent guesses.

This doesn’t apply to all areas, of course. I might need to accurately model the movement of Devin Booker prices and compare them to the market to identify in which sets he might be undervalued, for example—and that can done with a decent level of precision—but I didn’t need tons of data or accurate predictions to initially tell me to invest in Top Shot. I just needed to spot certain digital trends and ask the right questions. And doing that is easy: you simply never log off the internet.

Anyway, that’s sort of how I think about the EV of things on a macro scale. What’s the upside, what needs to happen to get there, and what are the rough chances of those things happening? For Top Shot, those assumptions and numbers still make a lot of sense to me. If NFTs grow, Top Shot—for a variety of reasons, including licenses, the best user experience in crypto, and a large moat—is highly likely to smash.

For the record, I haven’t sold any of my high-end Moments, which in addition to the Ja Morant includes LeBron, Zion, Lillard, and (another) Morant Cosmic and LeBron and Luka Deck the Hoops. I also (quietly) spent around $60,000 on the site in August. So I’m not just yapping.

Why That Particular Ja Morant Moment?

The No. 1 serial Ja Morant Cosmic…one of the great pieces of modern art.

The decision was really a three-person effort; I first got invested into Top Shot and told my soon-to-be Lucky Trader co-founders Peter Jennings and Jeremy Levine about it. Jeremy was heavily trading sports cards at the time and, I’m not even kidding, within a few minutes of playing with the site said, “Yeah, this is like 10x better than cards.” He predicted the market would move toward the traditional card market in terms of what’s valued, where the true blue-chips (like LeBron), rookies, and No. 1/jersey serials have a huge percentage of the overall cap.

With that information, we used Peter’s NBA knowledge to target the right player in the top set (with reason to believe it would remain that way), with the top serial, in his first Moment of his rookie season with his most iconic play.

The overall philosophy was the same EV-based one I outlined above, with the questions we needed to ask being:

- What are the odds Top Shot will go up in value?

- What are the odds this Moment will sustain or improve relative to the market?

- What’s the potential range of outcomes for its price in each scenario?

Again, if you’re finding the right macro bets, you can usually stop after the upside calculation. And if your projections need to be within a very specific range to show value on something, it’s probably not worth the time or money.

Let’s say we wanted to guess the price in a top 10% outcome for Top Shot, and we thought there was a 90% chance Morant would sustain his relative value in such a scenario.

That would be a 9% chance of Top Shot reaching a top 10% outcome and Ja at least retaining the same percentage of the Top Shot market cap, meaning if we thought the price of the Moment would exceed $388,889 (we did) in such a scenario, it would already be +EV without even considering any of the bottom 90% outcomes.

There are obviously many other possible positive outcomes and ways we could make money—maybe it’s worth half that amount in a top 20% outcome, maybe we sell it for some amount even if the market tanks, and so on — but if the EV is even close to positive considering the upside scenario alone, that’s likely a very asymmetric bet.

What’s the Value of the Ja Morant Moment Now?

It depends how you view it, but a lot more than $35,000. The cheapest Cosmic listed is for $145,000 and the cheapest Holo is $475,000. That’s not to say they’re worth that, but it does show people who own these Legendary Moments really aren’t listing them (there are only 10 of 74 Cosmic and Holo Moments listed for sale right now).

Various sites estimate the value of the No. 1 Cosmic Ja Morant at anywhere between roughly $290,000 and $400,000. I think it’s worth quite a bit more than that, but I also didn’t eat at a Red Robin until last year despite it offering one of the nation’s tastiest burgers, so what I say really can’t be trusted.

What I Got Right Last Year

The Top Shot Market Increased Substantially

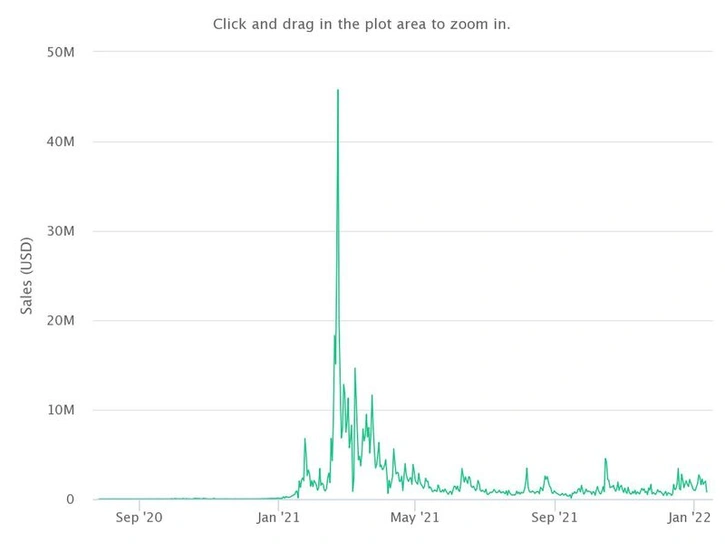

Prior to my article, Top Shot had done just shy of $3 million in January sales, according to Cryptoslam.io. They ended up doing about $37 million in the rest of January and $224 million in February sales.

A year later, after the market has cooled, Top Shot is on pace to do around $56 million in January sales, representing a roughly 10x increase from the pace in the first half of January 2021. Even after 12 months, it’s clear the demand for digital collectibles is still there.

Purchasing the Cosmic No. 1 Serial Ja Morant Moment Was Smart

In my original post, I wrote:

“Can we stop for a second to recognize the absurdity of this all? I was on the phone last night with someone named NonFunGerbils, waiting on a $35,000 transfer of Ethereum so I could purchase a video of Ja Morant you can view anywhere on the internet for free.

And the best part? I think $35k was a deal!”

Relative to the market, all three of these traits—Cosmic series, No. 1 serial numbers, and rookies (specifically Ja Morant) have increased in value.

Morant has the 7th-highest market cap of any player on Top Shot at over $11 million, aided by the rumor of rookie badges on the horizon coming to fruition. Cosmic has the highest market cap per Moment of any set, by far. Cryptoslam estimates the average Cosmic Moment for all players to be worth around $33k.

Basically, the hypothesis of “If Top Shot grows, this is the best Morant Moment to purchase” was probably correct.

I Was Mostly Correct With my Five Main Points About How Digital Assets Could Be Superior to Physical Ones

Ownership: Provable and unfalsifiable. Yes, everyone can look at your photo of a cat in a top hat, but they can’t sell your photo of a cat in a top hat, can they?

Authenticity: Unlike with physical art and other collectibles, NFTs make fraud mathematically impossible. Meanwhile, hundreds of millions of dollars of fake wine are still circulating from the deceit of just one man and the most expensive painting ever sold—Leonardo’s $450 million “Salvator Mundi”—might not have even been painted by da Vinci.

Honestly, the buyer should have known something was up when the same seller tried to give him a deal on this never-before-seen Leonardo self-portrait.

I guess the Louvre’s purchase of the forged “Mona Pizza” painting just tortoise nothing?

I’ll show myself out now.

Scarcity: This one is tricky. Future scarcity can be both guaranteed and not in certain ways, and I’m going to talk about the limitations of this in my predictions. It’s an important concept to grasp, I think, but the scarcity of certain NFTs—like Cryptopunks or Cosmic Top Shot Moments—is verifiable and irreplaceable. Compare that to the traditional sports card market, where companies have historically just printed whatever and no one can really guarantee at all how saturated a particular market might be.

Transparency: A few years ago, I started to get into traditional art a bit and started doing a little research to see if I could find any angles to profitably trade art. I started to look for data, and even something as seemingly straightforward as sale price was either impossible to find or extremely expensive to purchase. There’s no transparency whatsoever. The blockchain is completely transparent; we know who owns what, we know how much it sold for, we can see what offers have been made, we know when items are minted, we can calculate market caps, and so on.

Liquidity: Perhaps the biggest reason I saw NBA Top Shot and the NFT market exploding was due to the liquidity. Buy, own, and sell in an instant. Compare that to the traditional card market, where the obstacles to liquidity are outrageous.

Jeremy offered a great point about how that might change the industry, making a taxi/Uber analogy; many smart people used the overall market cap of taxis as Uber’s upside, when in reality—because of how much better the technology was—the real ceiling is many, many multiples of that.

Top Shot offered so much superior of a product in which so many people could instantly participate without the friction of traditional card trading that we correctly predicted the price upside wasn’t that of traditional cards, but many multiples. It’s an easy error in logic to make, but you can’t aptly compare new technologies to old industries.

And this might sound insane, but I believe the upside of the top Moment on Top Shot—the No. 1 Cosmic LeBron—is tens of millions and maybe even nine figures; that’s far in excess of any trading card sale.

What I Got Wrong or Missed

I Overlooked the Possibility of Such Rapid Growth

I was mostly viewing NFTs through the lens of a superior form of art/collectibles. And while that’s certainly where the early use cases have been, it became apparent pretty quickly that the future will extend far beyond those areas, in both the physical and digital worlds.

Although I was obviously higher on Top Shot and NFTs than the average person who’d yet to hear of them, if I had more conviction, I would have loaded up on certain types of NFTs. I’m now very bullish on Cryptopunks, for example—and I’ll explain why later—but I didn’t buy my first one until February 14, 2021. I wouldn’t have missed that with a better macro outlook on where things were headed. A lesson learned on tunnel vision.

I Didn’t See All the Possible Benefits of NFTs

While I think I was right about the advantages NFTs offer over physical forms of art and collectibles, I didn’t foresee many of the other benefits: utility, community building, aligned incentives for artists/companies and their buyers, and composability, for example.

The last one, in particular, is incredibly important. Since the blockchain is transparent, people can leverage and build on top of the success of others. Packy McCormick, whose Not Boring newsletter I highly recommend, has an incredible post on thinking of crypto/NFTs as “idea legos.”

Ideas and software can build on each other like legos:

Composability is one of the key features of web3. Chris Dixon defined it as the “ability to mix and match software components like lego bricks…Composability is to software as compounding interest is to finance.”

Compounding interest is just money building on itself. It’s math that, on a long enough time horizon, looks like magic.

Every time you earn interest, that new interest starts earning interest, too. Take $100k, buy a bond at 6% interest (ah, the good ol’ days), sit back, and end up with $1 million in forty years. Compounding is an easily quantifiable concept that’s hard to internalize. We underestimate its power often.

Composability is just software building on other software. Each new protocol or NFT is like a lego to snap into others. Each new combination becomes its own new lego block, until, a few interactions in, you end up with something exponentially more powerful than the original building blocks.

DeFi : Money Legos

— Jesse Walden (@jessewldn) September 3, 2020

NFTs : Media Legos

Had I properly applied what I already knew about fungible cryptocurrencies to non-fungible tokens—which really shouldn’t have been a huge leap but sometimes we overlook the most obvious of logical connections—I would have had a different vantage point of the future of NFTs and their ability to scale at an unprecedented rate.

My Early (Micro-Level) Top Shot Strategy Was Probably Wrong

In the initial article, I wrote:

“My strategy thus far has been to buy and sell as a way to learn the platform, reinvesting all of the proceeds into more Moments. My thinking is that it gives me more opportunities to find value as I collect data and learn, hopefully accumulating better and better assets along the way. Outside of purchasing the Ja Moment, which we plan to hold, I’ve found this superior to buying and holding because, frankly, I just didn’t know what I was doing in the beginning. The buy, sell, reinvest strategy sort of de-risks my portfolio without limiting the upside.”

My goal was effectively to try to “trade up” to Legendary Moments, which I believed (and still do) will retain value and have the most future upside, particularly Series 1. I was confident this was the right approach, meaning a better strategy would have been to just buy those Moments right out of the gate. If I wanted to practice on trading, I still could have done that at the low end.

This barbell strategy would have allowed me to secure Moments like the Ja Morant and my other Cosmics even earlier, and then learn the platform by trading at a lower cost. My former approach reminded me of dollar-cost averaging, which is fine if you’re putting everything you can into an investment at each stage, but is a horrible strategy if you can take on more risk earlier. If you had conviction in Bitcoin in 2015 and had X money to invest, putting in 10% of X every week or whatever would be silly, right?

When you have strong confidence in something, take on as much risk as you can (intelligently) stomach. And again, those situations should be coming around rarely. If you’re constantly finding all sorts of amazing opportunities, you’re just overconfident.

Lessons Learned and Predictions for 2022

In past posts from my Lucky Maverick newsletter, I’ve laid out some of the essential characteristics I seek when trying to decide if I should spend time or money in a particular niche or investment.

In How to Find the Next Big Thing, I wrote:

When it comes to finding the next big thing, I think you’re on the right track if you’re asking these questions:

1. What are kids (high school/college-age) interested in?

2. Which things that exist physically will move digital?

3. How will the democratization of ownership change the investment landscape?

Those questions are all still tenants of my overall philosophy, but I learned a lot about investing, specifically, in 2022, so I’m going to add to this list.

4. Which areas are growing despite serious technical flaws?

As I’ve written in the past:

Crypto’s detractors point to some serious flaws in certain aspects of the technology, many of which are very valid. There are cash grabs and hacks. Design is mostly very poor. Some of the shit you need to do to stake or farm in DeFi is just bananas. It’s very unapproachable for the average person, so they often just give up.

There are two ways to interpret these weaknesses. One is what I see from most, which is effectively “This is the disruptive technology you’ve all been talking about that’s going to change the world!?!? I don’t see much being changed and a lot of this is borderline unusable.”

The other interpretation is that crypto has seen incredible growth despite these obvious flaws, which is even more impressive. If this many smart people believe in the future of crypto, are leaving their jobs to work in the industry, and are part of an “intolerant minority” of believers, it makes the current limitations a sign of strength, in a way.

When you have true believers in something with very obvious weaknesses (but a path toward improvement)—and logical reasons to think there’s something special (such as trustless transactions)—that’s a great sign of opportunity.

We saw this happen in early 2021 with Top Shot, too. The site wasn’t ready to handle the unexpected exponential growth in users and often crashed during pack drops. People were pissssssedddd, and yet continued to come back again and again because, when live, the experience of ripping packs and transacting in the marketplace is sick. That incredible interest despite some early tech flaws was a bullish sign.

5. Which areas are growing despite appearing silly?

When you first learned about NFTs, it would have been weird if you really understood what was going on and believed that they were the future. No one had that experience.

My first introduction to NFTs was through digital art, and I thought it was the dumbest shit ever. My first exposure to Top Shot was immediately after they launched, but I was too focused on physical sports cards to be bothered. What. A. Dumbass.

But I occasionally saw NFT-related things popping up here and there, and after going down the rabbit hole, it finally clicked. Within days I was bidding 227 ETH on a .jpg of Vitalik Buterin and buying Cosmic and Holo Top Shot Moments not long after that.

No one thought I was sharp. Anyone I told thought I was a fucking lunatic, actually. But you can’t really be super early unless you see something others don’t see, and sort of by definition, that means you’re going to have to be okay both being wrong and being thought a moron. If you’re not okay with people thinking you’re an idiot—sometimes because you make giant mistakes and sometimes because they’re the morons not seeing what’s obvious to you—you can’t achieve unconventional success.

Note that both 4 and 5 are barriers to entry. If you find something difficult to use or confusing to figure out, everyone else is having that experience, too. Most will give up. That’s where the opportunity lies.

6. What obvious truth do you see that others don’t?

This will simply offer the greatest payoffs when you’re right, changing the EV calculation so you can be wrong more often and still achieve asymmetric upside.

One obvious truth I don’t see talked about enough: Red Robin’s diverse menu has a wide array of delicious items, in the off-chance you’re not in the mood for one of their burgers (yeah I know LOL yeah right of course I want one of their award-winning burgers).

So, with that said, I’ll leave you with a few predictions for 2022.

1. Top Shot Will See Another Huge Run That Far Exceeds 2021

We can discuss the improvements in user experience or new features or addition of NFL, but my argument is the EV-based one for finding asymmetrical payoffs that I laid out in the intro.

What are the odds digital collectibles (specifically trading cards) will grow overall? Very high.

What are the odds Top Shot wins in this area? For a variety of reasons (licenses, a huge moat, and an experience that doesn’t require knowledge of blockchain, among others), I think this is also very high.

2. Prices on Top Shot (and all NFTs) Will Continue to Trend Toward Blue-Chips

This has already happened quite a bit since a year ago, but I think we’ll see the trend continue even more. Top Shot can never make more Cosmic Moments. There will only ever be 10,000 punks.

But the more important question to ask with these NFTs is do they have a compelling story that adds to their value? Because guess what? There’s also only 10,000 Goofy Goats and Dumb Donkeys and Zany Zebras, and even though I’m just making these names up, there’s so many damn animal .jpgs that one of those probably actually exists so my apologies to that company.

The story with Punks and Cosmics is that they were the first. They’re internet artifacts. Their scarcity comes in that story, which makes them irreplaceable. Both could certainly lose value, but IF NFTs continue to grow, their place in the history of blockchain, the internet, and art makes them a good bet to appreciate, in my opinion.

Scarcity comes not in the number of NFTs in a collection, but in the irreplaceability of the story—their place as an artifact of a new digital age.

3. Experience and Utility-Based NFTs Will See Huge Growth

This is simply a logical consequence of the last point. Maybe some community-based NFT projects are sweet, but almost all of them are replaceable. Whether it’s access to events, NFTs as tickets, or a share of artist royalties, creators should be able to find unique ways to align with their fans with another year to figure it out.

I recently tweeted about how I believe NFTs can help the restaurant business, for example.

I have no interest in getting into the food business, but whichever restaurant solves NFTs first is going to smash. I eat out all the time, and getting a reservation to an amazing restaurant on a Sat night is still so difficult.

— Jonathan Bales (@BalesFootball) January 10, 2022

4. Play-to-Earn Games Will Skyrocket in Popularity

This is especially true with models like DeFi Kingdoms that can teach people about crypto through gameplay. Packy put it best in his article on The Pareto Frontier:

In The Financialization of Fun, Mechanism Capital’s Eva Wu wrote that she sees two major categories emerging:

1) “Play-first” crypto games where the fun gameplay takes centre stage and crypto is used as a competitive edge to engage players further.

2) “Earn-first” crypto games where the main allure, gameplay and fun ultimately come from earning money by participating in crypto game economies.

But if you’ve been reading Not Boring, you know that many of us are playing the Great Online Game, an infinite game playing out across the internet with crypto as the in-game currency. Work, creativity, investing, education, and nearly every aspect of our digital lives are undergoing the same transformation that’s happening in video games: the financialization of fun, and the funancialization of finance.

5. DAOs Will See a Massive Increase in Usage and Effectiveness

We saw something truly remarkable when a DAO was formed to buy the U.S. Constitution. The Constitution DAO failed in a sense, but not really. Why? Because right now, these types of things are experiments. Most of what’s happening in crypto—NFTs, DAOs, DeFi, and other new protocols—are tests.

And these tests are extremely valuable, even if they end up as failures, in the same way a failed business is valuable; it provides information to the entire ecosystem. The restaurant scene in New York City is the best in the world, in my view. I’ve traveled to many cities and still think, on average, NYC has the best food on the planet. That’s because there’s so much turnover; if a restaurant isn’t dope, it quickly dies off and is replaced by a better one that has the advantage of learning from all the things that didn’t work in the past.

This is what’s happening with DAOs, and because of crypto’s composability, the evolutionary cycle is not only faster than ever before, but speeding up over time.

6. The Metaverse Isn’t Close

I know the metaverse concept is hot, but the composable building blocks—the idea and code “legos” that are the foundation for exponential growth—aren’t there. It’s on the precipice for Top Shot, DAOs, DeFi, and web3 as a whole. More building blocks, faster growth, more talent, better engineers, even faster growth, even more building blocks. Once that critical threshold is reached, look out.

I don’t see that with the metaverse, at least not yet.

7. Fractional Investing Will Explode…and I Mean EXPLODE

Everyone can afford to buy Bitcoin, yet so many people haven’t realized you don’t need to buy “an entire Bitcoin.” The current value of one Satoshi—the smallest unit of Bitcoin—is fractions of a penny. When you buy some amount of Bitcoin—any amount—you’re buying a percentage of the overall network. When the price goes up, you get less of the network per dollar. When it does down, you get more. But you’re still able to buy any dollar amount that you’d like.

The same hasn’t historically been true for high-end art, wine, NFTs, and other assets. It’s not like you can buy a painting and chop it up into 1,000 little pieces and sell them for a profit. I mean, maybe not? The art world is weird af so idk actually maybe that’s a genius idea.

I’ve told this story once before, I think, but I went in with a small group to buy this legendary Honus Wagner card.

We just sold this card for $1,426,800 by far the highest price ever paid for a PSA 1 T206 Honus Wagner. We have over 1500 more lots that close tomorrow at https://t.co/EjwGaJI9mL pic.twitter.com/HOg6peBqEp

— Goldin (@GoldinCo) November 1, 2020

This card was a big impetus for me getting into NFTs. I really wanted to buy this card. Like really wanted it. I was so upset after we didn’t win the auction that I questioned why I wanted it so bad.

There was the guaranteed scarcity as a vintage card that wouldn’t be reproduced.

There was the irreplaceable story; this is arguably the most famous card of all-time, with only a few dozen left in existence, many of which will never be for sale. It is new-age art.

But one thing there wouldn’t be, at least for me: a physical card. We weren’t going to just like take turns showing this thing to our friends. It was going to be placed in a vault and hopefully never touched again. So what was I really buying? The concept of provable ownership of something with agreed-upon value.

As I started to go down the rabbit hole and connect the dots between my experiences in traditional card trading and crypto, I had to ask “Why does this need to actually exist in the physical world to hold value?” I of course realized that it doesn’t.

So anyway, as we were discussing the merits of the card, I brought up that fractional investing of alternative assets was sort of catching on with sites like Rally (and now Fractional within the world of NFTs), and that this might 1) increase the value of blue-chip assets in the future, and 2) allow us to fractionalize and sell ownership of the card.

Fellow gambler Empire Maker was part of the deal, and when I said “You know, we might be able to chop up the card into smaller portions and sell them,” his exact response was “You want to cut this card into fucking pieces? Who’s going to buy a cut-up card!?”

So I explained I meant “chop up” as in fractionalize it into smaller parts that people could buy. He responded “Who the fuck would want to buy just a fraction of something?” to which the other investor on the call responded “Literally us, right now.”

Most people can’t afford to buy a Cryptopunk, but why shouldn’t they be able to have access? This is in the early stages of changing, and I predict 2022 will be a huge year for the democratization of assets. It’s effectively good for everyone; non-fungible items can get fractionalized and tokenized to become fungible, providing a liquid market to which anyone can gain entry.

And it’s why I’m so bullish on the most high-end assets. If Honus Wagner cards are selling for millions of dollars and only the ultra-rich (or a group of schmuck gamblers) can afford them, what will the price be when anyone who wants a piece can get exposure?

Wagner cards, Basquiat paintings, Cryptopunks, the fucking U.S. Constitution, and, yes, LeBron legendary Top Shot Moments…the future of blockchain-based fractional investing will have a profound impact on the price of blue-chip assets.

Final Thoughts

In conclusion, I really think Red Robin is one of America’s great restaurant chains. With nearly 600 locations currently in operation, you’re never too far away from a great-tasting burger at an affordable price.