Crypto and NFT Taxes: What Do I Need To Know Before 2022?

As we approach the close of arguably the craziest year in crypto history, we also need to start thinking about t*xes (censored because we know the immediate terror that comes along with the word). We know it's scary, but we've brought in our friends at RKO Tax to help!

RKO was founded by Allie and Sean this year after it became clear that there was a gap in the space that they could fill with their tax accounting knowledge. With over 10 years combined tax experience, RKO aims to leverage tax and accounting knowledge of its founding partners to provide high-touch, white-glove tax service to the crypto-native community. If you are interested in learning more about RKO, please feel free to reach out to Allie, Sean, or RKO (@RKOTax) directly via Twitter (the website is in the works, but remember rko.tax!).

If you are worried about your tax position for 2021, or even want to just learn a little more about how you can position yourself in the most beneficial way possible before the end of the year, you have come to the right place.

1. Understand the Assets You Hold

Maybe you only hold Ethereum, Bitcoin, or Solana. Maybe you were involved in some degenerate yield-farming in 2021. And maybe you hold some NFTs. All of these assets are treated differently from a tax perspective so it is important to understand what you hold and how it will be treated if sold.

Cryptocurrency (ETH, BTC, SOL, etc.):

Tax treatment: Capital assets

Tax rate(s):

- Short-term holding (<1 year): ordinary tax rates*

- Long-term holding (>1 year): preferential tax rates (0%, 15%, 20%)**

Yield Farming:

Tax treatment: Ordinary income upon claim, capital gain upon sale

Tax rate(s): ordinary tax rates* upon claim, capital asset classification (above) upon sale

NFT:

Tax treatment: Collectible

Tax rate(s):

- Short-term holding (<1 year): ordinary tax rates*

- Long-term holding (>1 year): 28% flat rate for collectibles. While the IRS has not issued official guidance on NFTs, the conservative stance is to treat them as collectibles rather than the more advantageous Long-Term capital gain rates of 0-20%.

Token Drops:

Tax treatment: Ordinary income upon claim, capital gain upon sale

Tax rate(s): ordinary tax rates* upon claim, capital asset classification (above) upon sale

2. Take This Opportunity to Harvest Some Losses to Offset Any Taxable Gains Before the Year Closes.

If you have capital gains that you realized in 2021, you can take this opportunity to harvest some losses to offset those gains! In the tax world, your overall short-term or long-term capital gain position is calculated by netting gains and losses to come up with an overall gain or loss position. This means that if you are currently sitting in a gain position, you have the opportunity to sell some assets for a loss to help offset some gains.

It is worth noting that the maximum total loss you can take in a given year is $3,000. If your losses exceed $3,000, any excess is carried over to future years to offset the gains recognized in that year.

Example:

Max has $10,000 in long-term capital gains in 2020. At the same time, however, he has $20,000 of losses. His net capital gain/loss on his 2020 return would have been -$3,000 with the residual $7,000 carried forward.

In 2021, Max has $45,000 in recognized gains and no losses! He currently stands with a $38,000 gain on his tax return since he can use up the loss carry-forward from 2020. If he wants to lower his taxable gain for 2021, he should sell some assets at a loss.

3. Take Advantage of the Wash-Sale Rules That are Going to Change Effective 1/1/2022

If you hold any assets that have depreciated in value over the course of the year but you want to hold long-term, there is an opportunity for you to sell the asset for a loss before the end of the year to soak up some losses to offset your capital gains. Once the asset is sold, you can re-purchase the asset with no time restrictions to reclaim your position.

In the traditional finance world, this would be known as a wash-sale if the transactions (sale & repurchase) occurred within 30 days of each other. These rules do not apply to crypto for 2021, so you should take advantage of this before it goes away.

It is important to note that the repurchase will reset your cost basis to the most recent purchase price and could potentially result in a higher gain if sold in future years.

Example:

Alex purchased 100 of Coin 1 in 2018 for $150/coin. In 2021, the coin has plummeted to $50 but Alex believes it will bounce back in future years.

Alex sells all 100 shares of Coin 1 on August 1st, 2021 at a price of $50/coin. Alex has a loss of $100/coin, or $10,000 ([$50 - 150] * 100 = $-10,000).

Alex then repurchases 100 shares of Coin 1 at $50 on August 2nd, 2021. Alex’s new basis in Coin 1 is $50. This means if the price of Coin 1 skyrockets to $500 in 2025 and Alex liquidates his position, he will have a long-term capital gain of $450/coin, or $45,000 ([$500-50]*100 = $45,000).

Alex can use the $10,000 loss he realized in 2021 to offset his 2021 gains on his tax return.

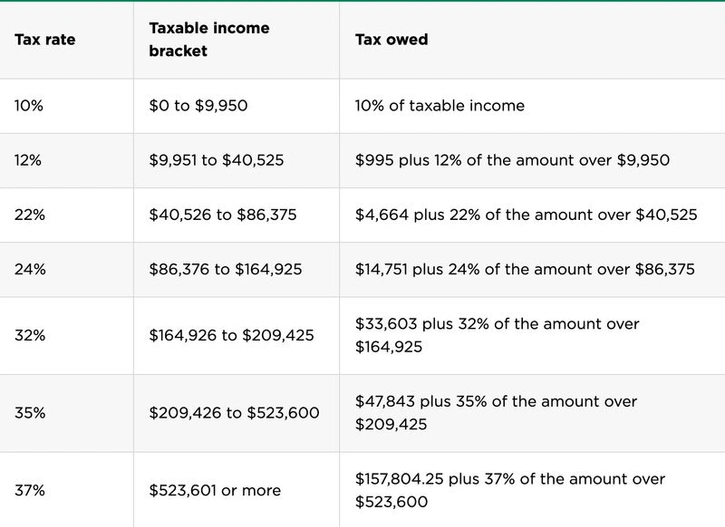

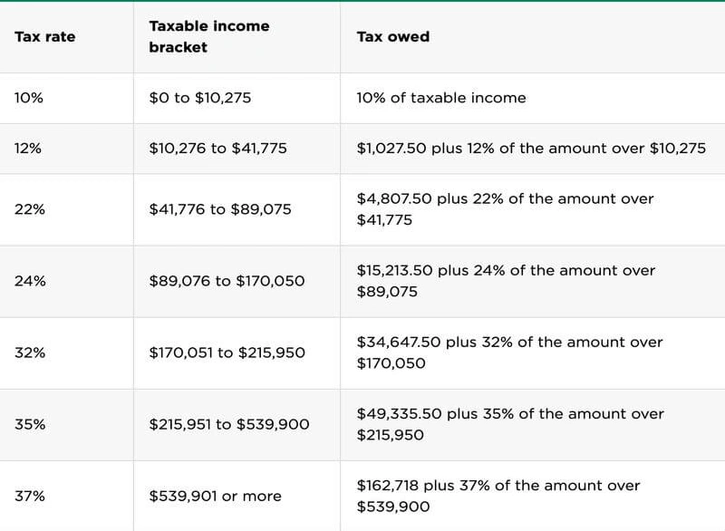

4. Tax Plan for Updated Tax Brackets in 2022 ***

The 2022 Federal tax rates have been adjusted to account for inflation. The highest income tax rate of 37% is now reached at an income of $539,900 instead of $523,600 for 2021. If you fall into this tax rate, not much is changing for you in 2022 other than you will have slightly less income taxed at the highest marginal tax rate than you did in 2021.

If your income level falls in one of the lower tax bands, however, 2021 provides an opportunity for tax planning around expected income in 2022 and your anticipated tax rates. If you expect to fall into a higher tax rate next year due to a new project or maybe you got a raise at your job, it may be worth selling some assets to lock in the tax at your 2021 rates as opposed to your 2022 tax rates.

This will likely only be applicable if you were considering selling something regardless of the timing between 2021 & 2022, but because capital gains are taxed at essentially your highest marginal rate (tax is calculated after employment income), you may see some significant tax savings by selling in 2021 as opposed to 2022.

Example:

If you make $150,000 at your job in 2021, you will fall into the 24% tax bracket (as a single filer). This means that any $ earned on top of your salary of $150,000 will be taxed at 24% until your income surpasses $164,925, at which point it will be taxed at 32%.

At this rate, if you are thinking about selling an asset worth $10,000, it will be taxed at 24%.

If you got a raise and your anticipated salary for 2022 is $200,000, you will fall into the 32% tax bracket and any additional dollar earned on top of your salary of $200,000 will be taxed at 32% until your income surpass $215,950, at which point it will be taxed at 35%.

With the 2022 rates and salary adjustment, that same asset that you wanted to sell for $10,000 would be taxed at 32% instead of 24%.

2021 Federal Tax Rates (single filer):

2022 Federal Tax Rates (single filer):

On the contrary, if you are expecting your income to remain at the same level in 2022 as it was in 2021, on paper, you should see a tax savings built into the adjusted rates.

5. Prepare for Your Tax Liability (i.e. Transfer Some Crypto to Fiat to Prepare for Your Estimated Tax Bill)

This one is obvious, but it is also a double-edged sword. If you need to sell assets to pay for your tax bill, there are built in tax implications (as mentioned above). The easiest way around this is to harvest some losses with coins that have gone down in value or sell some assets (NFTs) that have underperformed.

The opportunity here with the loss harvesting is this - if you believe in the project, sell the asset to secure the loss and repurchase at the lower price. You will have some extra capital to cover your tax liability, and you will also harvest some losses to offset some of your (hopefully) gains.

In addition to your federal income tax liability, keep in mind you will likely have a Net Investment Income Tax (NIIT) tacked on to your federal tax liability in addition to your state tax liability. The NIIT is a flat 3.8% assessed on capital gains (likely including NFTs) at the federal level.****

6. Start Closing Out 2021 and Preparing for 2022

Now that 2021 is coming to a close, it is a good time to start locking down an accountant (if you do not already have one) and start thinking about the fourth quarter estimate for 2021. If you make quarterly payments, the last one for 2021 is due on January 15th, 2022.

If you aren't sure if you should be making estimated payments, the general rule of thumb is: you need to pay 100% of your prior year tax liability (110% if your adjusted gross income is over $150,000) or 90% of the current year tax liability by the tax return due date (likely April 15th of the following year).

If you aren’t sure if you should be making an estimated tax payment, talk to your accountant.

Check your year-to-date withholding and payments to see if it conforms to the 90% of current year or 100% (or 110%) of prior year tax liability rule. This will be important to keep in mind over the course of 2022 as the payments are due at the following cadence:

Q1: April 15th

Q2: June 15th

Q3: September 15th

Q4: January 15th (or with a timely filed tax return)

7. Buckle Up, It's Going to Get More Complicated With the Proposed Tax Changes!

Finally, keep an eye on the proposed tax law changes or make sure you are talking to your accountant about how some of the rules could affect you. The biggest one for the crypto space is the wash sale rules - these will be expanded to include crypto assets, as mentioned earlier, and any sales and repurchases made within 30 days of each other will now be treated as a wash sale, meaning there is no recognized loss on the transactions, but any gain would be taxable and increase the basis of the asset.

There are some positive changes - NIIT will apply on income earned at higher levels and there are some renewed energy tax credits for home improvements and the purchase of electric cars.

You can read more about the proposed changes here.

If you have any questions about any of the information in this article, please reach out to your accountant or RKO Tax on Twitter.

*Ordinary Tax Rates

**Preferential long-term capital gains rates:

*** 2022 Tax Rates:

****Net Investment Income Tax:

Income filing charts courtesy of NerdWallet.com