Weekly NFT Preview | Embrace the Chop

We just closed one of the more quiet NFT weeks in recent memory, including some of the single lowest volume days (July 2 saw just $11.8M in OpenSea volume) of 2022. Most of the top PFP projects have been chopping in this low liquidity environment, leaving the consensus market "bored".

But for those following the market closely, it is anything but boring. New trends and themes are emerging with regards to where liquidity is going, and last week had ample opportunities for profit for those who understood where to look. Here are the current hot NFT sectors:

- ENS

- Free mints (and the most hyped paid mints)

- Digital art

ENS

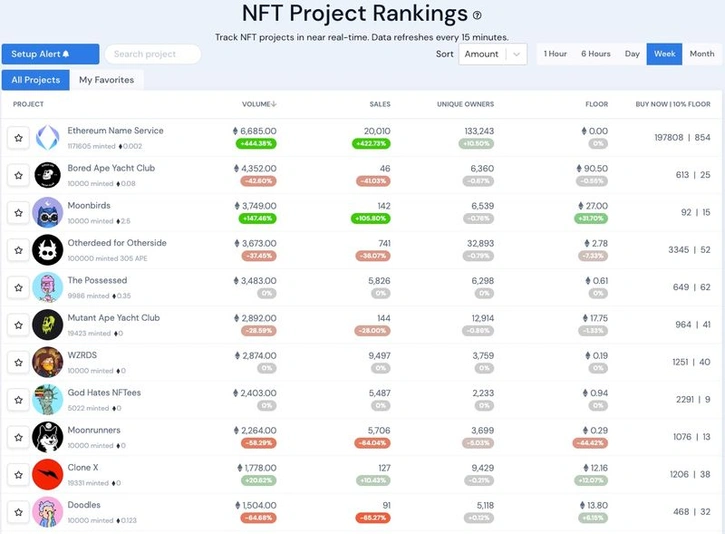

ENS mania is back and seems to be here to stay. Weekly volume was over 6600 ETH and topped the 7-day board. New categories and clubs are forming by the day and minting out with great speed. The release of a killer new tool ENS Vision has helped this market greatly, creating easier linking and tracking of activity for these specific categories. This influx of volume and better tools has sent some floor prices through the roof, including:

- 999 Club (3 digit numbers): 34 ETH

- 10K Club (4 digit numbers): 1.888 ETH

- Arabic 999 Club (Arabic character 3 digit numbers): 3.9 ETH

- Chinese 999 Club (Chinese character 3 digit numbers): 1.05 ETH

- 3L Club (3 letter combos): 0.15 ETH

Some are calling this ENS action a bubble, but the same was said when the 999 Club was hitting the 5 ETH level, and bubble or not, the demand is real. The week also saw some incredible top-end sales, including 000.eth selling for 300 ETH, porno.eth selling for 184. eth and ٠٠٠.eth selling for 100 ETH. With this level of high-end sales, it's doubtful this mania slows down any time soon and will remain a big focus for the days and weeks to come.

Free Mints

Free mints meta is still here and strong, evidenced by three of the top ten weekly movers being free mints. The top projects, WZRDS, God Hates NFTees, and Moonrunners, combined for over 7,500 ETH in an extremely volatile week. God Hates NFTees was the top winner, seeing its floor price rip all the way to 1.5 ETH+ at peak, before falling back to 0.94 ETH at the time of writing. WZRDS caught major steam on the mint day, running past 0.4 ETH before relegating to the 0.2-0.3 ETH range for most of the long weekend. And Moonrunners, last week's big winner, fell 44 percent to 0.29 ETH on the week though has remained relevant (and not zero).

Shelf life is always the most important question for these projects, as they trade on attention and as soon as the attention is gone, they typically trend to zero. From a trading perspective, it's important to find those that have potential "attention events" on the horizon (i.e. WZRDS altar launch, Moonrunners snapshot) and trade around those. Additionally supply seems as important as ever, as God Hates NFTees (5K supply) did less overall volume than WZRDS (10K supply) yet ran four times as high, so be incredibly mindful of that metric (along with % listed).

Each of those was surpassed by the top paid mint of last week, The Possessed. The Possessed did 3,500 ETH volume in its first few days of trading, running past 0.8 ETH at the peak before settling in the 0.6 ETH range ahead of revealing this week. Minting out at 0.25 ETH presale and 0.35 ETH public, this project proved that paid mints can still work as long as demand is high enough. This one will be a big focus of volume around the reveal on Thursday and could be a big winner if they can manage a bullish reveal.

Digital Art

Digital Art continues to heat up this summer, though still does not seem to be commanding much attention. Art Blocks has been a big winner, and last week's Curated drop Sudfah was a smashing success from a trading perspective, with the floor quickly 2x'ing from mint price and seeing several top-end sales in the 6-10 ETH range. Top Curated sets continue to march up, including Ringers now at 59 ETH floor (+31% on the week), Elevated Deconstructions at 43 ETH (+23%), Meridians at 11 ETH (+22%), and Squiggles at 10.95 ETH (+17%). Not only is Curated winning but so are the Factory drops, as projects which have been sitting open for weeks and months for minting are slowly minting out. There are just 29 open projects right now, down from the high 30s just last week, a great sign of increased demand.

The OG generative project Autoglyphs had a big week, seeing 2 sales on the week and moving from 230 ETH floor to 299 ETH. Mint Passes have benefitted as well, with the Goda pass reaching the 11 ETH range before falling overnight to 10 ETH, and Gmoney's Admit One reaching 20 ETH floor.

The 1/1 scene also seems to be heating up, as leading emerging artists like Grant Yun and Jack Kaido are selling new pieces within hours of minting, at all-time high prices or close. There were multiple three-digit ETH sales in the past week and a big Beeple sale at Christie's ($250k+).

Those three areas have been big winners lately, as the market focuses less on the top-end PFP projects.

But there were a few notable stories from PFP land, highlighted by Moonbirds and Doodles.

PFP Market Recap

Moonbirds was able to be the primary PFP outlier, jumping 31 percent on the week as Ryan Carson's fund made a big sweep, and then another round of buy action came yesterday as the Moonbirds "Ravens" trademark was revealed, hinting at the new potential airdrop or expansion set. The floor ran all the way to 35+ ETH at peak on July 4, before quickly falling back to the 28 ETH range (quick side, nesting/staking seems to lead to much more volatile and violent retraces post-sweep than normal listing environments). This will be the primary PFP to watch in the next few weeks, with the next nest unlocking in just 16 days and all eyes on the next potential airdrop + Oddities reveal.

The Doodles led headlines for a chunk of last week, as their Bucket Auction ended up generating over 12K ETH in primary sales with the final price at just over 0.5 ETH for the 20K public sale. Secondary action for the Genesis Boxes has been underwhelming, to say the least, with the floor falling 20 percent to 0.41 ETH and seeing just 470 ETH volume. The Doodles floor was up seven percent on the week, at 13.8 ETH, though the question remains of how it will maintain attention ahead of the big Doodles 2 launch coming later this year.

The Yuga ecosystem chopped on the week, with BAYC holding 90 ETH floor (-0.5% on the week) and MAYC at 17.75 ETH (-1.75%). Azuki and CloneX combined for less than 3K ETH between them but did each see a nice ten percent bump on the week, CloneX on the back of their full-body clones and IP rights delivery. But similar to Doodles, the question now turns to what will be the catalyst for the next leg up for these top sets.

So with the PFP projects in chop mode, what's a trader to do? Identify the new trends and themes and focus there (as laid out above) or stay on the sidelines. For those in the arena, this is where I'm focused for this incredibly quiet week:

- WAGMI United

- More Free Mints

WAGMI United

The top mint for this week is likely from the WAGMI United team, as it releases the highly anticipated results of its PREMINT raffle, and 1,000 lucky winners will be able to mint up to two NFTs for a TBD price (likely in the 0.3 ETH range) on July 6.

This project crosses sports (soccer club Crawley Town FC), art (Squiggles on the jersey), and utility, as collectors will be able to help govern the DAO and football club, receive physical and digital merchandise and gain access to IRL events. The partnership with Adidas has certainly given this one more credibility, though its ownership group already speaks for itself (Gary Vee, Gmoney, Snowfro, and more).

With Adidas and this group of heavy hitters, expect some huge attention on this NFT drop. The PREMINT raffle is bringing in collectors from several different sectors of the NFT space (art, PFPs, sports) and with such a quiet week of new drops, this one could really steal the show. Whether or not a DAO can effectively manage a sports club is a different question (and we will see!), but should not impact early price action. Supply is the big open question here, but as long as it's manageable (~10K or less), it should have high potential to be a very profitable mint.

Our goals:

— WAGMI United (@WAGMIUnited) June 27, 2022

⁰1. To reinvent broken legacy sports management models

2. To give fans a meaningful voice

3. To take Crawley Town FC, the smallest team in the English Football League, to the Premier League

More Free Mints

Every week it's typically the stealth-free mints that steal the show, generating hype in just days or hours pre-launch. This makes it very hard to predict which ones will do well at the beginning of the week, as often the schedule is not even known. But this week, we do have a starting list of free mints and including here for easy tracking:

- Moopy NFT: 6,789 NFTs (9:00 a.m. ET Tuesday)

- Soulda16: 7,777 NFTs (11:00 a.m. ET Tuesday)

- Perfidiouos: 1,500 NFTs (9:00 a.m. ET Wednesday)

- Uncultured: 5,555 NFTs (9:00 p.m. ET Wednesday)

- Children of Ukiyo: 10,000 NFTs (9:00 a.m. ET Thursday)

- WAGMI Army: 6,969 NFTs (2:00 p.m. ET Thursday)

Free mints remain the best risk/reward trade in the NFT space right now, as the downside is so low and there's real upside as we have seen in recent winners. But more and more traders are realizing this, making the entry points harder and gas fees higher on the more anticipated drops.

Of all of these, WAGMI Army has by far the biggest following at over 69k followers on Twitter and seems to be the most hyped free mint of the week, at this point. It has mfer vibes and a sub-10 supply, two good signs of the bat.

Keys to watch with these free mints - who is minting them (i.e. sharps?), can they reach "exit velocity" price points (over 0.1 ETH) and can they gain more than 500 ETH in secondary volume? Those three alone don't guarantee success but certainly are strong indicators of those that have potential to run up, at least temporarily. Other keys to success here are having a defined exit multiple (i.e. 1.5X entry price, 2X, etc.) as well as "stop-loss" exit points for projects that start dipping fast. With bankroll management on entry and a smart exit strategy, traders can position themselves in low-risk / high upside spots a few times per week.

One word, WAGMI

— WAGMI ARMY (@wagmiarmynft) June 16, 2022

Free mint + 0% royalties pic.twitter.com/5ykv18FfSy

Conclusion

The NFT bear market rages on but has been anything but boring for those paying close attention, and new trends are surfacing. Expect these recent themes to continue this week (ENS domination, free mint meta, art), and the most likely scenario for top PFPs is continued chop (other than Moonbirds which seems on an upward trajectory right now).

Traders have a choice here - learn the mechanisms of this new bear market and how to trade it, or stay on the sidelines. Both are fine options, though one is certainly more fun (and more profitable if executed properly).

Stay up to date with all the info needed to inform your decisions with the Lucky Trader newsfeed, and good luck out there!